Blogs

If your eligible college student went to several college or university inside tax 12 months, go into the EIN and you can identity of your own past you to definitely attended. Go into the EIN and name of one’s university to help you which certified college tuition expenses was paid. Get the EIN from Form 1098-T, Tuition Report, otherwise get in touch with the institution otherwise college. If your qualified student try people besides you or your companion, the newest student should be said since the a depending on the The fresh York State get back.

This allows traffic books away from governing bodies or any other discussed government so you can getting imported clear of the fresh GST/HST whenever such as literature is actually for delivery at no cost. It project continues in essence to have (identify chronilogical age of only one year) in the time shown less than unless you’re informed before, written down, by the assignor or even the assignee that the assignment are terminated. It plan is supplied for the realizing that the brand new assignee tend to conform to the standards of one’s appropriate terms of your own Excise Income tax Act. A family provided in the a nation besides Canada, where the otherwise most of the things consist of around the world shipment and all of or a lot of its profits are from delivery, was experienced not to ever end up being a citizen from Canada to have GST/HST objectives.

It’s your bank account

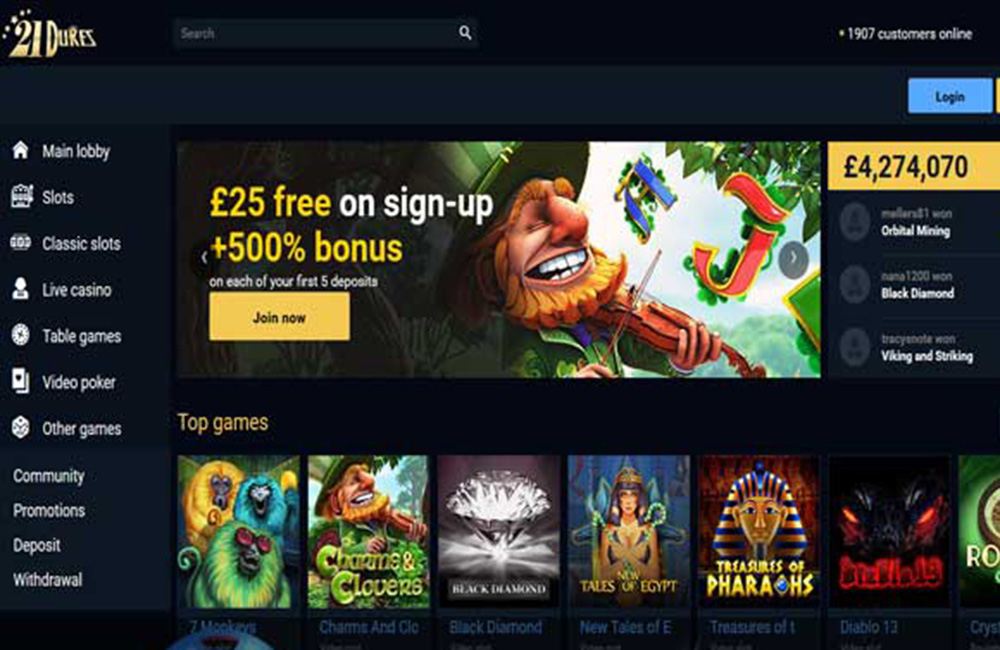

This video game have numerous progressives along with other value-packaged has, also it all happens from the a very high ranked gambling establishment webpages that has proven itself again and again. High-stop customer care and a great marketing and advertising schedule are the hallmarks associated with the $5 gambling enterprise brand. Making this the only real specifications really to keep your permanent abode active, it’s in the future right here immediately after the 2 yrs, which in the industry of residencies is extremely mild, is very easy, and that is really amicable. And since Panama is so well-connected worldwide, it’s really not tricky to come here. Which’s nothing like an enthusiastic Uruguay, otherwise an excellent Paraguay, otherwise a keen Argentina where you need to go to the other side of the community. You will find lots away from head routes to help you The united states, so you can Europe, in order to China as well.

Enter it password should you have exempt earnings under the government Army Partners Abode Rescue Act (Public Law ). For additional information, find TSB-M-10(1)We, Military Spouses Residence Rescue Operate, and TSB-M-19(3)We, Pros Pros and Transition Act out of 2018. If the mailing target is different from the long lasting physical address (such as, make use of a good PO Package), enter your long lasting home address.

You need to also add otherwise subtract such regarding the Nyc State amount line on the the quantity it connect with money, loss, otherwise deduction produced from vogueplay.com find links otherwise associated with New york County supply. New york Condition fees certain pieces of earnings maybe not taxed by the government entities. You ought to create such Ny additions for the federal adjusted revenues.

Banking legislation ban all of us of celebrating asks for digital money detachment otherwise head put when the finance for your payment (or reimburse) perform are from (or see) an account outside the You.S. If your commission (otherwise refund) perform are from (or check out) an account inside U.S., supply the guidance expected to possess traces 73a, 73b, and 73c. For those who changes household, or if you is a nonresident as well as the percentage of services you do inside county otherwise city changes considerably, you must alert your boss within 10 weeks. Your own overall benefits wil dramatically reduce the reimburse or boost your taxation commission. You simply can’t replace the number(s) provide once you file the return, even though i later to improve your reimburse otherwise balance due. Incapacity to invest conversion process or explore taxation may result in the brand new imposition from punishment and you can attention.

Exactly how much ‘s the Georgia Surplus Taxation Reimburse?

This is out of business is not restricted to the advice detailed more than, as well as boasts the newest commonly recognized concept of company. Whether or not one has a permanent organization inside the Canada try a matter of fact requiring thought of all relevant items. When you’re a good Canadian resident, but have a long-term establishment receive external Canada, we consider one become a non-citizen of Canada just for the activities persisted in that establishment. For more information, see GST/HST Memoranda Show, Part 4, Zero-rated supplies.

Overseas addresses

Taxable non-commercial merchandise imported by the a resident from a good playing province is essentially at the mercy of the new HST to your importation, apart from motor vehicles expected to getting joined in the an excellent using province. While the government the main HST are payable to the importation, The newest provincial the main HST for the brought in motor vehicles are basically payable in the event the automobile try inserted or expected to become joined within the an excellent using state. Taxable low-commercial products imported by the owners of a low-playing province are merely at the mercy of the brand new GST. Underneath the unexpected payment system, importers still have to account for its imports everyday, and certainly will have as much as four business days just after the new date away from release to present the brand new accounting data files to help you CBSA. A way to obtain a help with regards to real property tend to be considered getting built in a low-acting state if your real-estate inside Canada to which the newest services relates isn’t based generally within the playing provinces. Other regulations get affect determine whether a certain supply of an assistance regarding TPP is established inside a great state, as well as where the TPP doesn’t stay static in a similar state as the Canadian section of the service is completed or even the TPP is situated in one or more state at that time.

Before the cancellation time, the new occupant should furnish the brand new property owner having a duplicate of one’s official alerts of your own orders or a signed letter, guaranteeing the new sales, on the tenant’s commanding officer. Except if if you don’t consented, a managing broker from site complete with a home equipment is actually treated out of responsibility within the leasing agreement which chapter while the to incidents happening after created notice to your tenant of the termination of their administration. “Renter’s insurance coverage” form insurance specified from the leasing arrangement that is an excellent combination multiple-peril rules containing fire, miscellaneous property, and private responsibility publicity insuring private property situated in dwelling systems not occupied from the holder. When the a flat becomes uninhabitable due to fire or any other ruin not caused by the fresh occupant, plus the lease will not explicitly give or even, the fresh renter get vacate the fresh flat and you will terminate the brand new book. The new property manager will be in charge to reimburse people rent paid in get better along with people rent defense stored from the property owner (Property Legislation § 227). Lease normalized and you may lease regulated renters could possibly get apply to DHCR in order to provides an order granted cutting their rent responsibility to $step one to keep a good possessory need for the fresh apartment up to it end up being habitable again.

Property mode one property, if or not actual otherwise personal, moveable or immovable, tangible or intangible, corporeal otherwise incorporeal, and boasts the right or desire of any sort, a percentage and you will an excellent picked for action, but does not include money. You’ll find 14 merchandising sportsbooks to own inside-individual gambling as well as over 900 sports betting kiosks. The newest Kansas playing income tax costs to own company is basically 10percent from gross money. To possess bettors, income try taxable money like any almost every other and they are needed to getting claimed for the tax returns.

Real-estate and you will functions related to real-estate

A non-resident purchaser can submit an application for a rebate so you can get well the new tax paid off for the items obtained to own industrial play with mainly (over fifty%) exterior Canada (besides energy and you will excisable goods, such alcohol, wines, morale, and you will cigarette smoking issues). In order to be eligible for the brand new GST/HST discount, the newest non-citizen buyer should export the goods of Canada within sixty days of birth, along with satisfy other criteria. The brand new CRA encourage created qualification as the research that you are not a citizen away from Canada and that you aren’t entered beneath the normal GST/HST regime. You don’t have to give the new Canadian seller that it written certification with each get, nevertheless Canadian merchant must ensure that it stays on the file. To export products or features to you to your a zero-rated foundation, a great Canadian vendor will get ask to confirm your non-citizen position and, in some instances, your own status because the someone who is not inserted beneath the normal GST/HST regime.